Maybe you’ve heard this story before: A company comes up with what they think is a good idea, but they move from ideation to production too quickly and their product falls flat in the market, costing them dearly in terms of time, money, and pride.

Great ideas and groundbreaking innovations are what drive businesses forward, but it pays to test a concept before investing in its production. Concept testing is a way of perfecting an idea before it’s released to the world. It can also help companies save time and money, and even protect them against a disaster — as many as 80% of all new product launches fail each year, according to The Business Journals.

Whether it’s a new product, a new website, or a new logo design, getting feedback on an idea is invaluable. And one of the most effective ways to get quantitative and qualitative feedback on an concept is through a survey.

Group Respondents

Aside from standard demographics, you should look for additional ways to group respondents. These could be things like customers vs. non-customers, recent buyers vs. those intending to buy, or owners of a similar product vs. non-owners. Creating these groups ahead of time can help you determine what questions to ask, set up quotas, and save time on the back end.

In terms of data, creating these sorted groups can give you a better understanding of how different demographics react to your concept. For example, if your current customers have a negative response to your concept but non-customers are generally positive, this could give you insight into how to market your product or service if it moves forward.

Determine Purchase Intent

If you are testing a product or service, what you ultimately need to know is whether or not someone would purchase it. This is a very simple but important question to ask — it should typically be the first question asked after the respondent is shown the concept.

Keep the question basic. “How likely would you be to buy this product?” will suffice. The most commonly used scales are 5, 7, and 11 point (0-10).

Ask Key Questions

When creating questions for your concept testing survey, it’s important to remember exactly what you want to know about your concept and why you’re asking the questions. Set a specific goal for your concept test, such as, “I want to know if my current customers are willing to spend more for a higher-quality product,” or “I want to know if customers will associate my new logo with the same brand.”

If you’ve already drafted a series of ideas for your concept, whether it’s a piece of packaging, a design, or a basic product idea, it can sometimes be easier to provide your respondents with images and examples rather than simply asking them a question. For example, if you have several designs for a new logo, you could ask your respondents use an interactive slider to rate each of them.

Every concept test needs to ask a core set of questions. These questions can vary depending on what you are testing but should be centered around these concepts:

Appeal

When asking respondents about the appeal of a product or service, you can ask about their first impressions: “What is your initial reaction to this product?” You can also ask for a written response: “What do you like most about this product, in your own words?”

Uniqueness

Questions about uniqueness can help you determine if your product or service is innovative or is different from similar options on the market. Your question could be as simple as, “how innovative is this product?”

Relevance

Questions about relevance determine how important that product or service is to the respondent given their unique context. For example, this could be determined by a question like “is this product something you need?”

Price

You will need to determine how much the target customer is willing to pay for the product/service. One way to do this is using Van Westendorp’s Price Sensitivity Meter, which asks what would be somewhat expensive, too expensive, a good value, and too cheap.

Evaluate Messaging and Features

To launch a successful concept testing survey, you must identify the messaging that resonates with respondents and the product, service, package, ad, or other concept you are testing.

To do this ask the respondent what they think about specific features, attributes, and/or potential messaging about the concept. For example, you may wish to ask any of the following questions:

- How appealing are following the features?

- Which of the following attributes are most important to you?

- How well do the following statements describe the product?

- How believable is the product description?

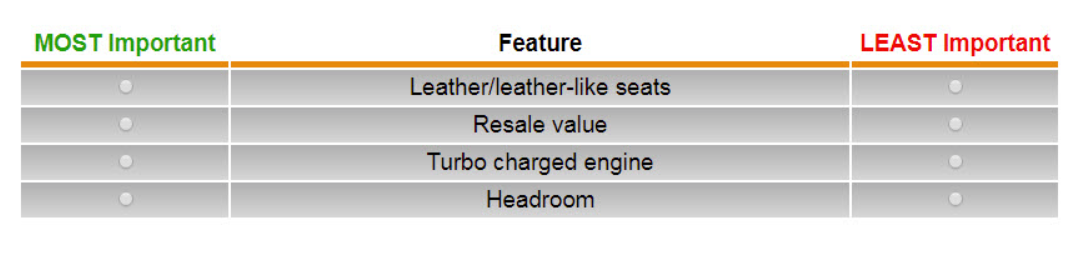

The type and format of your questions are also important, not just for the enjoyability of your survey but to your data. Some question types you can use are ordinal scale questions, likert scale questions, multiple choice questions, or Max-Diff questions, like the following:

Discover Likes and Dislikes

Ask respondents what they like and dislike in an open-end question. The benefit of an open-ended question is the opportunity to get objective feedback from your respondents without any restrictions. In addition to data, an open-ended questions can give you more detail about your respondents’ reactions and more actionable feedback. Another way to discover what respondents like and dislike about a concept is to use a text or image highlighting exercise. Show respondents the concept and have them highlight specific words and/or click on parts of the image they like and dislike.

Create a Concept Testing Survey

If you’re looking for early points of weakness in a product or service, a concept testing survey can help you fix those issues before launch. It could be that the concept at hand includes several assets, all of which need to be assessed, or it could be a simple selection of design or piece of packaging.

No matter how complex the concept, choosing the right questions and keeping respondents engaged are key steps to running a successful concept testing survey.

/How%20to%20Determine%20the%20Right%20Survey%20Incentives/Survey%20Incentives%20social%20image%202.jpg)